How to build a robust trading strategy

A trading strategy is an essential aspect of successful trading. Many traders learn technical or fundamental analysis and want to jump into the markets right away, but there are a few things you have to figure out before doing that. What type of trader are you? What markets are you going to focus on? These crucial steps are what we will cover in this lesson.

How to build a robust trading strategy

There is a huge amount of markets you can dive into. Not to mention you can approach trading as a day trader, scalper, or swing trader. Once you’ve decided on these things, it is time to select a strategy that will get you in and out of the market.

What type of trader are you?

This should be the first question you ask yourself because it will influence not only the number of markets you will actively trade but also your trading strategy. There are four types of traders. Scalpers, Day traders, Swing Traders, and Position traders.

Scalpers and day traders focus on short intraday timeframes. The only difference between them is that scalpers take a lot of trades during the day and day traders rather hold positions for intraday swings. This trading approach requires a high focus during a trading session. Therefore, it might not be suitable for someone with a full-time job. But if you have a full-time job and still want to be a day trader/scalper, you can choose a market that moves the most during certain trading hours when you are free. This is one of the biggest pros of choosing this type of trading style, you don’t have to watch the market the whole day. All you have to do is pick a certain time during the day that has a large influx of volume and you should be able to find an actionable setup almost every day. If you have less time, you may focus rather on swing trading.

Swing trading is done at higher timeframes and generally requires less focus during the day. Most swing traders analyze charts once a day and only watch their positions every few hours. Swing trading requires a large amount of patience as you will only find an actionable setup once every few days. Also, because you often hold positions overnight, you have to be prepared for more risk due to expected and unexpected macroeconomic news releases.

Position traders, also called investors, hold trades for months or sometimes years. This is something that requires a large sum of capital and you will hardly become a position trader early on in your career.

Choosing the right markets to trade

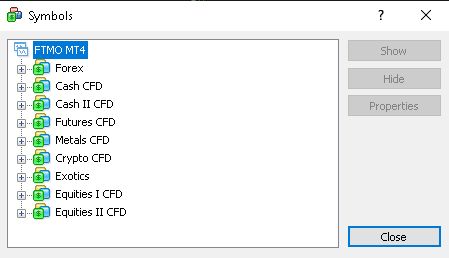

If you take a look at our FTMO platform, there are Forex, Indices, Commodities, Crypto, and Bonds. All of these combined make over 100 different instruments you can trade. Would you be able to trade all of them?

Of course not! Being able to keep up with such a huge amount of instruments constantly is unrealistic.

This is why you should narrow your choice depending on your trading style. If you decide to be a swing trader, you should pick a handful of instruments to always have something to trade. Most swing traders trade anything between 10-20 instruments which they analyze once a day and then narrow their focus on those that offer them good trading setups. If you decide to become an intraday trader, you don’t need to watch 10-20 instruments. In fact, most intraday traders focus only on one or two.

And what instruments should you be watching?

That is completely up to you. We have recently published a video about instruments traded in the financial markets so you can learn all the useful insights about different instruments there!

Once you have chosen the right set of instruments and want to focus on a more intraday approach, you need to ensure you will be available to trade them at the right time of the day.

If you decide to swing trade, this is not so much of a concern as you will set up limit orders that will fill throughout the whole trading day.

Building a trading strategy

First, you should ask yourself whether you want to focus on Technical or Fundamental Trading. Fundamental Analysis tries to predict the value of an asset based on micro and macro fundamental events. If you are doing a fundamental analysis on Forex you might be looking at the economies of two countries and the currency you trade. When trading indices like SP500, you pay attention to the overall risk-on and risk-off environment. It is always important to keep up with all major economic releases such as NFP, FOMC, or CPI.

Technical Analysis is based on watching the price of an instrument and looking for different patterns and behaviours that happened in the past, so they might happen again in the future. Although most traders try to only focus on one type of analysis and completely ignore any other, the truth is the mix of both (or more) will bring you the greatest success in trading. Once you’ve decided on what type of analysis you want to use in your trading, it is time to set up exact rules for entering and exiting your trades. Every robust trading strategy should have exact rules on when to enter and when to get out of a trade. You can use pretty much anything for getting in and out of trades.

As an example, we can use a simple strategy that is looking at horizontal support and resistance levels paired with 200 Simple Moving Average. In the example above price bounced off 200MA and closed above, this can be used as our entry trigger with stop loss below the low and target at prior resistance. Your trading strategy can be pretty much anything, but you must know what you do in each step. Once you have your trading strategy, you can go through historical data and backtest it.

Conclusion

Building a robust trading strategy is a must. As traders, we have to know the exact steps of what to do throughout the trading day, and our strategy is our guide for that. The information in this article may be useful for you if you wish to focus on intraday or swing trading, figure out what trading hours you are going to pay attention to in the market, and what fundamental or technical practices you will use.