CCI: Technical Indicator

Want to sharpen your trading skills? Learn how to use the Commodity Channel Index to spot momentum shifts and improve your market timing.

What is CCI: Commodity Channel Index?

The Commodity Channel Index (CCI) is a powerful technical analysis tool that helps traders accurately spot momentum shifts. It measures the difference between an asset’s current price and its historical average price. Originally introduced by Donald Lambert in 1980, CCI has since gained popularity for its ability to detect overbought and oversold conditions with precision.

How Does CCI Work?

Unlike indicators such as the Relative Strength Index (RSI) or the Stochastic Oscillator, which operate on a fixed scale from 0 to 100, CCI is an unbounded oscillator. This means it can move above or below any level, offering a broader view of market momentum.

Specifically, it uses key thresholds to signal strength:

Above +100: Signals bullish momentum

Below -100: Signals bearish momentum

Commodity Channel Index Formula

This formula allows traders to quantify price deviation, which helps in identifying potential market reversals or continuation of trends. The Commodity Channel Index is calculated using the following formula:

CCI = (Typical Price – SMA) / (0.015 × Mean Deviation)

Where:

- Typical Price (TP) = (High + Low + Close) / 3

- SMA = Simple Moving Average of TP over a selected period (usually 14 or 20)

- Mean Deviation = Average deviation from the SMA

- 0.015 = A constant multiplier to normalise the CCI values

How to Use the Commodity Channel Index

CCI is a versatile tool that can be applied across multiple markets, including forex, stocks, indices, and cryptocurrencies. However, for optimal results, it should be used in conjunction with market sentiment analysis or other indicators. CCI has several practical uses. Here are three popular methods traders rely on:

1. Trend Identification

CCI helps determine the direction and strength of a trend.

- When the price crosses above +100, it typically indicates an emerging uptrend.

- When it drops below -100, it suggests a downtrend.

- Furthermore, readings above +200 or below -200 may indicate very strong trends.

2. Overbought and Oversold Conditions

CCI also serves as an indicator of market extremes. If CCI is above +100, the market might be overbought, which could lead to a price correction. Conversely, if CCI falls below -100, it may indicate an oversold market and potential buying opportunities. Therefore, this use case can help traders time entries and exits more effectively.

3. Divergence Signals

Another powerful application of CCI is identifying divergences, which often signal possible trend reversals.

Bearish divergence: Occurs when the price forms higher highs while CCI forms lower highs. This could signal weakening momentum and a potential sell setup.

Bullish divergence: Happens when the price forms lower lows while CCI creates higher lows, suggesting that selling pressure is waning and a reversal might follow.

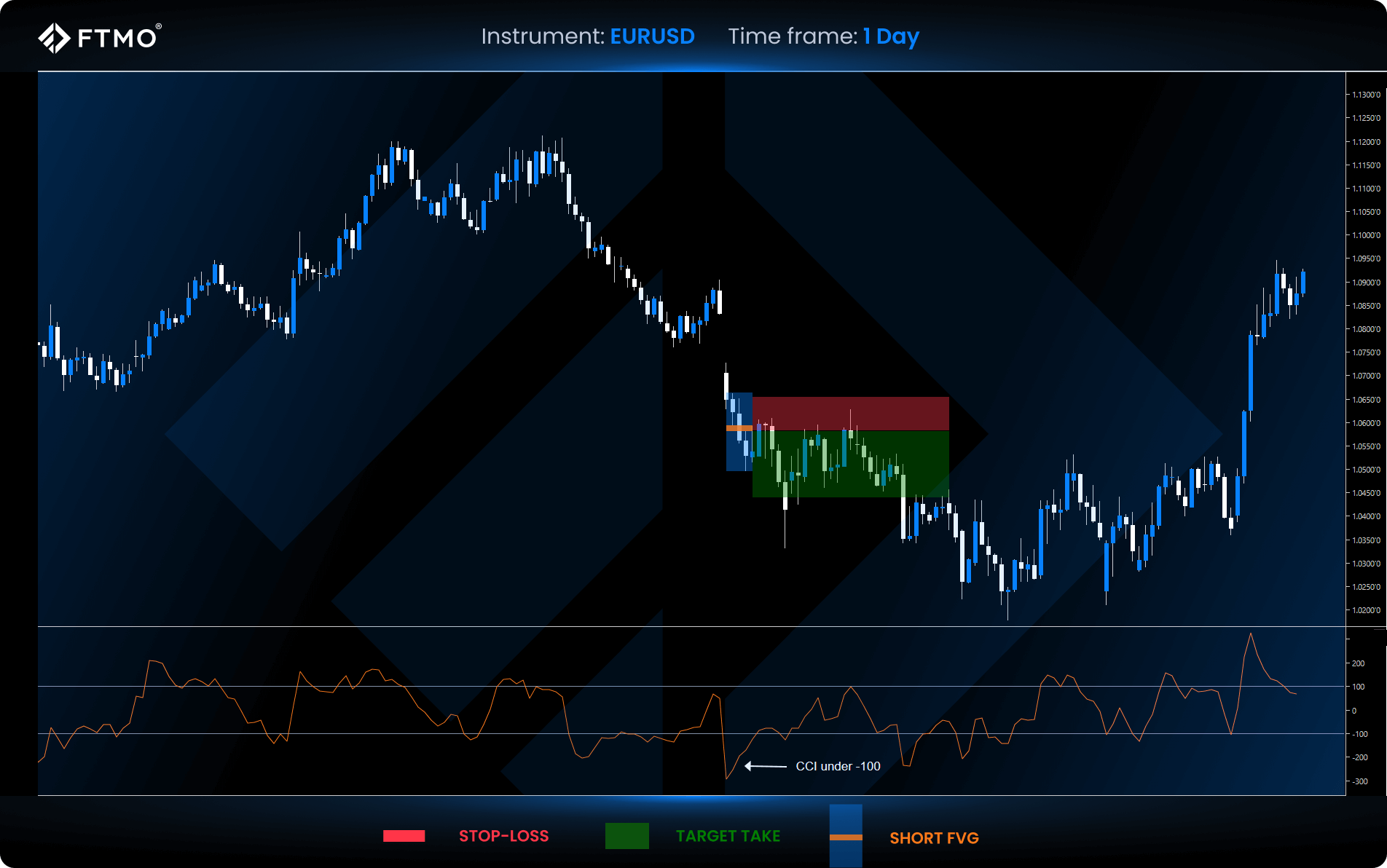

CCI Trending Strategy

This strategy combines CCI signals with a price-action formation called the Fair Value Gap (FVG), which helps pinpoint precise entries and confirms trend strength.

Notably, it is best used in trending markets, especially in highly volatile instruments like certain forex pairs, indices, and cryptocurrencies.

Entry Rules:

Long Position: CCI must be above +100, and a long FVG should form.

Short Position: CCI must be below -100, accompanied by a short FVG formation.

Exit Rules:

Target: A fixed risk-reward ratio (RRR) of 1:2

Stop-loss: Should be placed at the nearest edge of the FVG candle, as determined by the gap structure.

Key Takeaways

- CCI helps traders gauge momentum by comparing the current price to its historical average.

- By combining CCI with tools like moving averages, MACD, or RSI, traders can improve signal accuracy and reduce false entries.

- CCI can be used by trend-following traders, particularly when combined with other momentum indicators, to identify high-probability setups.