Forex Market Structure and Participants

Forex is a huge market which attracts a lot of different participants. Who are they and what is their motivation to trade forex? Let’s find out!

Who is trading forex and why?

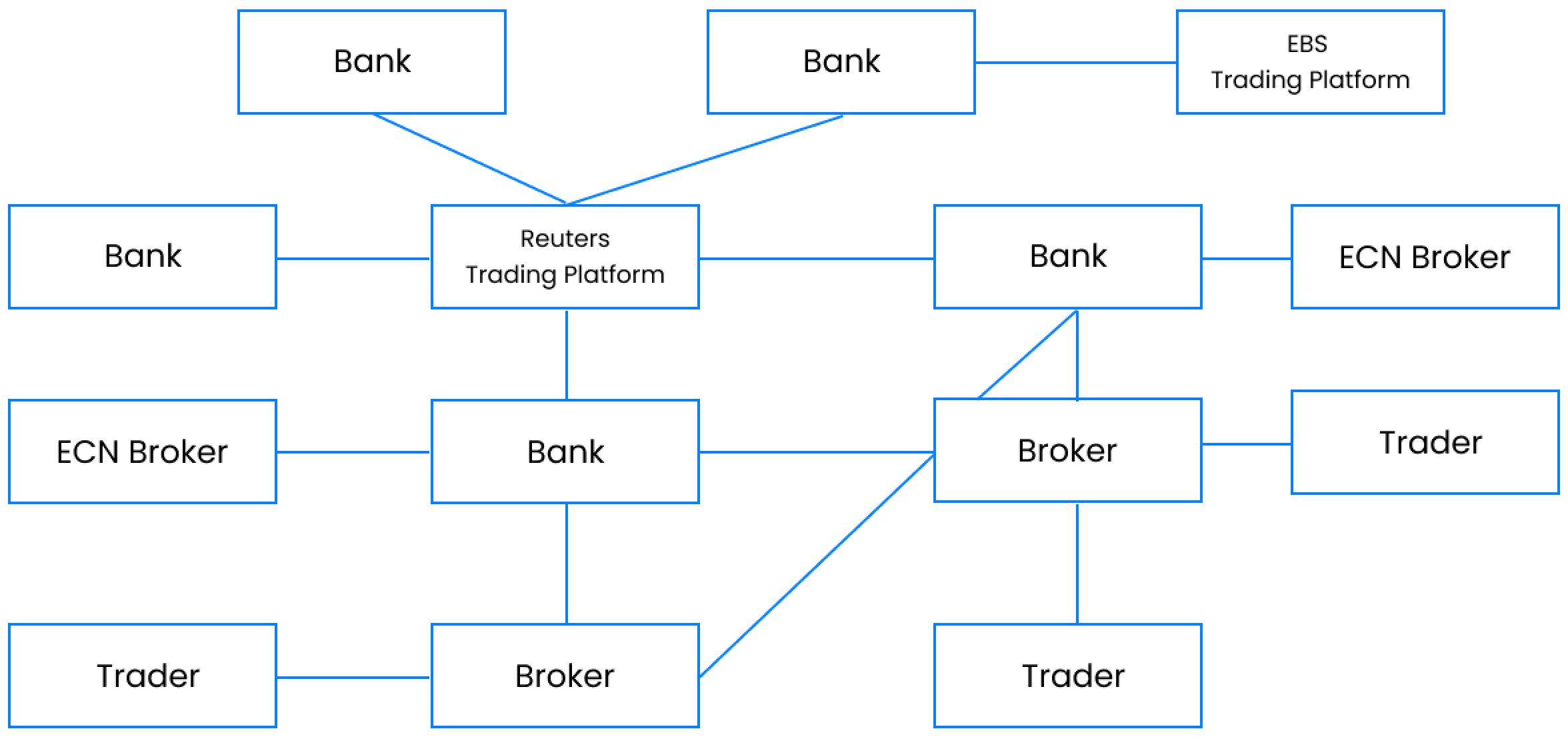

So now that we know what forex is and its unique characteristics compared to futures and stocks, we will talk about the structure of the forex market, brokers and participants.

One of the main advantages of trading in the OTC market is that it is not controlled by any individual or group of people. For example, there can be a case where the New York Stock Exchange just shut down one day, this cannot happen in the forex market. On the other hand, the forex market is less transparent as we cannot see the volume or depth of the market.

Forex brokers

In the forex market, there are two types of brokers, A-book and B-book brokers.

The A-book brokers are preferred by forex traders because they use an electronic communication network (ECN) or straight-through processing (STP) that gives their clients direct access to the market as the trades are passed right to the liquidity source. The B-book brokers operate as market makers. Orders are processed in-house by the broker. In other words, orders placed by traders are not visible anywhere other than the broker’s trading platform. There isn’t any external liquidity pool and brokers often act as a counterparty to their clients’ trade. Because they win when their clients lose, this always stirs up a discussion about market manipulation and some other lawful practices.

This is not so true as every broker who is regulated has to act in a regulatory standard and they don’t want to manipulate prices simply because they would lose all their clients sooner or later due to the huge competition in the forex broker industry.

Every licenced broker can fill the trades internally through the B-book model or pass them to the real market as an A-book. That’s why we might be thinking that we are trading on an ECN broker, but in fact, we are not. If we want to find out what type of broker we are trading, we can ask the customer support of our broker, or we can try to open a trade during high-impact news.

A-book brokers will more likely give us slippage because they send orders to the real market, where order books are very thin during news releases.

B-book brokers will fill us out immediately as they take the other side of our trade.

Market participants

Now that we know the structure of the forex market and the types of brokers, we will cover the different participants.

Banks, funds, institutions and small retail traders meet every day. The large participants do not speculate about the prices, they more often use forex trading for hedging purposes. Let’s now have a deeper look at each participant and what their intentions are in the market.

National or central banks

These banks determine the exchange rates based on supply and demand for the currencies. The large banks are also called the interbank market. They make the bid and ask spread, and they take huge amounts of transactions every day for themselves or their customers. Deutsche Bank, JPMorgan, Citi, HSBC, Bank of America or Goldman Sachs are the most famous ones.

Investment companies and hedge funds

Investment companies and hedge funds are also one of the big players in the forex market. They diversify their capital which is easily done thanks to the high liquidity of the forex market. They also use the forex market to exchange currencies for international payments.

Corporations and commercial companies

Corporations and commercial companies are doing business in the forex market because many companies are importing and exporting goods worldwide. They have to make payments in different currencies, and because of that, they exchange a large sum of money every day at the forex market.

For example, if Tesla wants to buy parts in Switzerland, they have to exchange their US dollars for Swiss francs first.

Speculators and investors

Speculators buy and sell currencies to profit on the exchange in the future. We can separate speculators as large and small ones. Large ones are usually smaller hedge funds or proprietary trading companies. Small ones are the retail traders. From over $6.6 trillion, which is the daily volume in the forex market, retail traders make only around 2-3%. A carry trade is a popular vehicle for making money for larger speculators. Carry trade is using a currency with a lower interest rate to buy a currency with a higher interest rate.