How to read COT

Forex trading is a zero-sum game, for every winner, there has to be a loser. Take a guess who is more likely to be profitable. Retail traders or big banks and hedge funds? Well if you guessed that banks, you are right. Retail traders are at a disadvantage with the amount of information we have in the markets. Luckily for us, there is a way to follow what the big players are doing. In this lesson, we are going to take a look at the Commitments of Traders reports and how they can help with our trading.

Commitments of Traders reports

What is the Commitments of Traders reports?

Commitments of Traders (COT) reports are published weekly by the Commodity Futures Trading Commission (CFTC). The reports show open positions by all the subjects that must report their positions at CFTC. These are positions by big institutional subjects. These big players report their positions every Tuesday evening, and the reports are published every Friday at 3:30 pm EST (9:30 pm CE(S)T). The COT reports show approximately 70 – 90% of open positions in futures markets. These reports aim to provide transparency to the futures market and prevent price manipulation. Although these reports are from the futures market, we can use this information in spot currencies and CFD trading since spot forex pairs go hand to hand with currency futures and commodity, metals and index futures are the same as their CFD counterparts.

What subjects can we find in the Commitments of Traders reports?

Commercials are the most important players in the markets as they often hedge their holdings and tend to have the most insight into the movement of future prices. In a healthy trend, we should watch commercial positionings going with the trend.

Large Speculators – trading firms and hedge funds who speculate on the markets to gain profits. These tend to be right most of the time, but there are some exceptions to that.

Small Speculators – private investors and retail traders don’t have to report their positions to CFTC.

Where are the Commitments of Traders reports published?

The original version of the COT reports can be found on the CFTC website.

There is also more interactive version to display data, such as barchart.com.

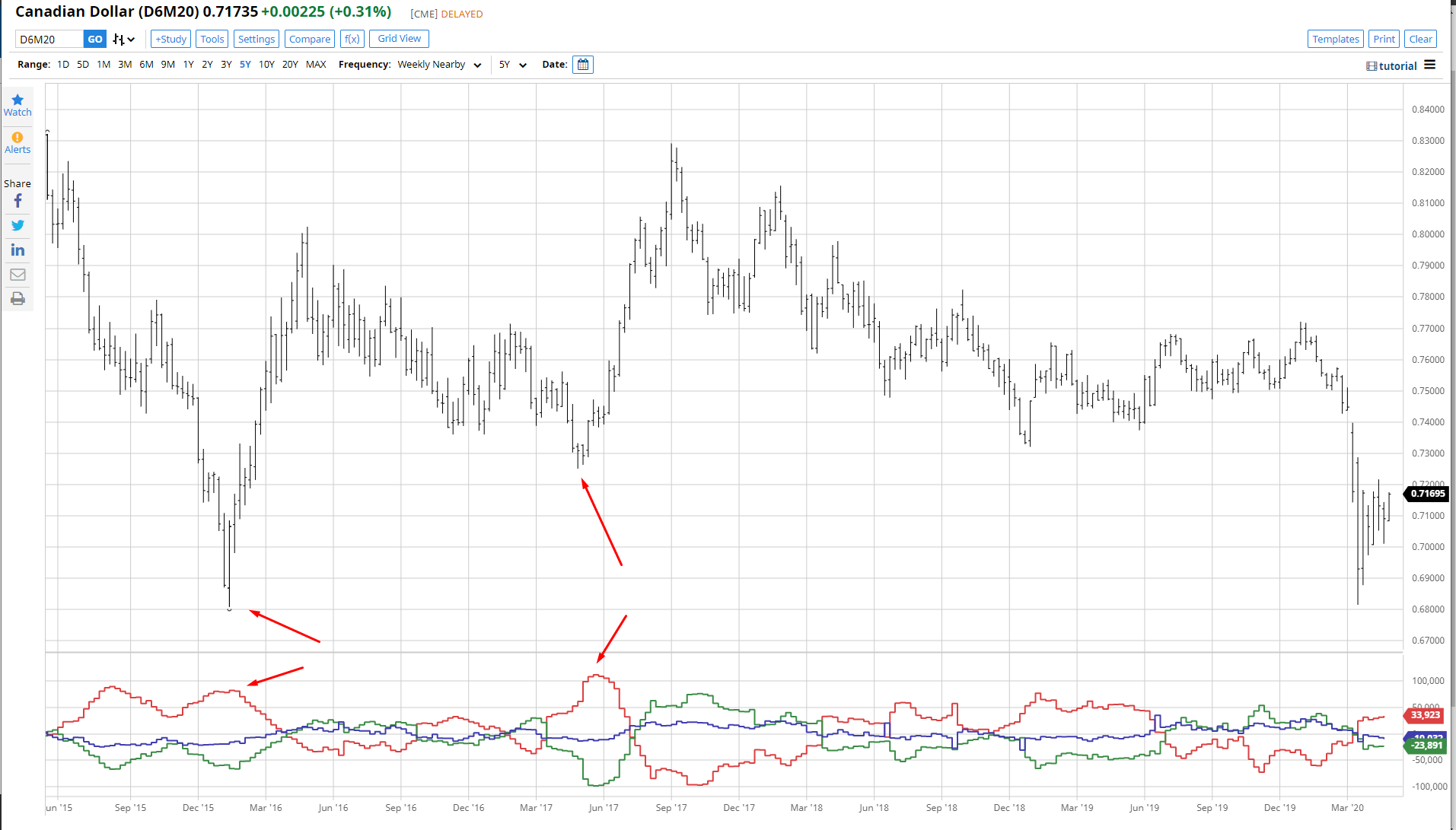

As we can notice on the above chart of Canadian dollar futures, commercial participants (red line) were heavy long in both early 2016 and mid-2017; both of this information signalled big trend moves in the market for the following months ahead. As this showed us the strength of the Canadian dollar, we could use this as a trend move of USDCAD short.

Conclusion

The Commitments of Traders reports are a great tool to help us understand the market sentiment, but these reports should serve us only as a beneficial advantage to our analysis and there should be discretion exercised while using them. When we are watching the reports, it is generally perceived not to look at low time frames but to rather stick with daily/weekly time frames and look for big extremes where we can find a big difference between commercial and small speculator’s positioning.