How to spot breakouts and fakeouts

In this lesson, we will cover how you can trade breakouts and fakeouts.

Trading breakouts and fakeouts

Breakout trading is a popular trading strategy followed by many traders and trading algorithms. There are two ways you can spot a breakout, the first one is by using price action, and the second is by using technical indicators that measure volatility.

What is volatility?

Volatility measures price fluctuations over certain time periods. When there is high volatility, markets go back and forth very quickly; when there is low volatility, markets are trading in tight ranges. During times of low volatility, we can expect breakouts to occur. Bollinger Bands, Keltner or Donchian Channels are the most popular indicators to measure volatility. They measure volatility based on different indicators such as moving averages or Average true range. Another way of looking at volatility is by using price action. You can use horizontal support and resistance or different chart patterns to spot a possible breakout. Breakout trading can be considered an impatient approach as breakout traders often use stop or market orders to chase rising volatility.

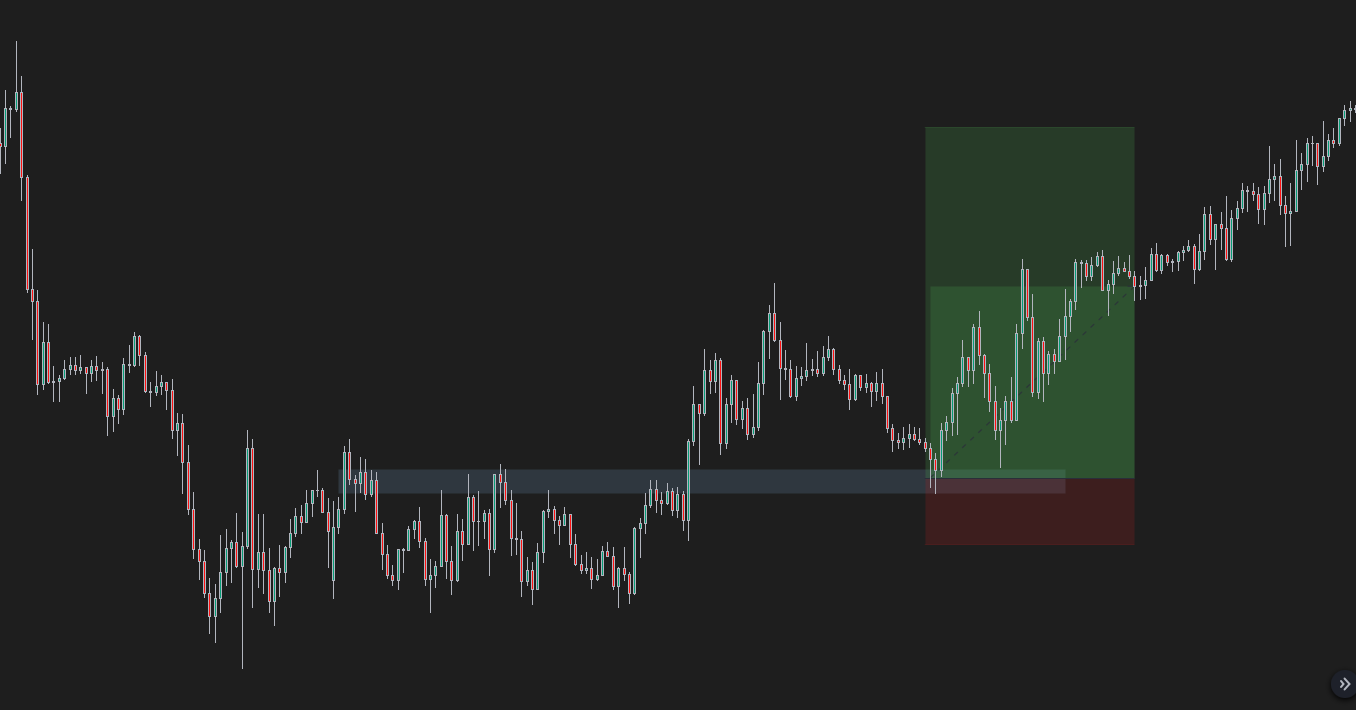

This can work, but very often, we can see false breaks above and below existing ranges. These false breaks happen for one simple reason, above and below every easily recognizable price range, you can find two types of orders. If we take a look at an example of horizontal resistance, which was already tested in the past, above it, we can find stop-loss orders from traders who are already short and also buy stop orders from traders that are anticipating a breakout.

Because both of these essentially buy orders, they bring a large amount of liquidity, in other words resting orders, to the market. Large market participants often use this liquidity and absorb all the buy orders with their large sells. This will result in a false breakout above the resistance and continuation down. Not becoming a victim of these false breakouts is not that hard; all you need to do is not put your stop-loss to obvious places where there is a high likelihood of other traders having their stop-loss. Another thing is trying to have a little more patient approach rather than having a “fear of missing out”, and after you see a breakout outside of any tight range, wait to see if new prices will be accepted or not.

Of course, there will be situations where you will miss out on the breakout, but more often than not, waiting for the breakout and placing a limit order to an area where the breakout occurred can be a smarter play.