Introduction to Financial Markets

Financial Markets and Institutions are a big term. There are a lot of components within financial markets and a lot of things to cover. This is why we have prepared a complete guide for you where you are going to learn about the basics and more advanced concepts as well.

What are financial markets and institutions?

A financial market is a place that provides the ability to exchange different financial assets. Through this exchange, you can buy and sell assets such as foreign currencies, stocks, bonds, commodities etc., in exchange for money. A capital market is one of the main parts of the financial market. Investors and issuers meet at the exchange every day. Issuers gain funds at the exchange of their own business, while investors can gain ROI (Return on investment). The exchange takes the form of a double-sided auction, where the final price of the traded instrument decides the state of supply and demand. The price thus obtained is called a course.

World’s biggest centralized exchanges

NYSE – New York Stock Exchange (USA) – The largest exchange in the world as measured by the market value of securities traded

NASDAQ – National Association of Securities Dealers Automated Quotations (USA)

Euronext – European New Exchange Technology (Europe)

FWB – Frankfurter Wertpapierbörse – Frankfurt Stock Exchange (Germany)

LSE – London Stock Exchange (United Kingdom)

TSE – Tokyo Stock Exchange (Japan)

All the above-mentioned institutions are so-called centralized exchanges – being characterized by the settlement of a transaction between the buyer and the seller. It is the central place where the price is determined, settlement of trades is called the clearing.

On the contrary, a decentralized exchange is not physically or logically linked to one particular place. The market, therefore, operates on the basis of a link between the participants, without a central authority.

Structure of a decentralized exchange

Decentralized market

Decentralization is the very process of distributing the decision-making powers of central authorities. Decentralization is one of the most attractive attributes of cryptocurrencies, which cannot be controlled by any central entity. For example, in peer-to-peer systems, it is Bitcoin which requires no central authorities for its transactions. Unlike centralized exchanges and exchange bureaus, their decentralized “sisters” are just a kind of interface that connects two people who want to make a shift and the rest is on these participants.

Main characteristics of a decentralized exchange

- Allows its clients to have control over their own resources

- Does not have a central server that could become the target of cyber attacks

- Not controlled by an individual or a narrow group of people

- Respects the privacy of its clients and does not require lengthy forms of registration or fulfilment of KYC (know your customer) standards

The decentralized exchanges also include the foreign exchange market. In regards to forex, we use the term OTC.

What is an OTC (over-the-counter) market?

OTC (over-the-counter) market is a decentralized market without a central physical position, where market participants trade with each other through various means of communication, such as telephone, email, and proprietary e-commerce systems. In the OTC market, traders act as market makers by stating the prices at which they buy and sell securities, currencies or other financial products. A trade can be made between two participants in the OTC market without others being aware of the price at which the transaction was completed. In general, the OTC market is usually less transparent than stock exchanges and is also subject to less regulation. The OTC market is primarily used to trade bonds, currencies, derivatives, and structured products.

Forex

The currency market is the largest and most liquid financial market in the world. Trading is allowed 24 hours a day, 5 days a week through repeating Asian, European, and North American sessions. Thanks to the boom in online trading, it is available to almost everyone.

The average daily trading volume is around “$7.5 trillion” (In 2022. Source: bis.org), which is about 10 – 15 times more than the daily volume of trades on the world’s stock markets. The currency market is decentralized, there is no specific trading floor such as NYSE for trading stocks.

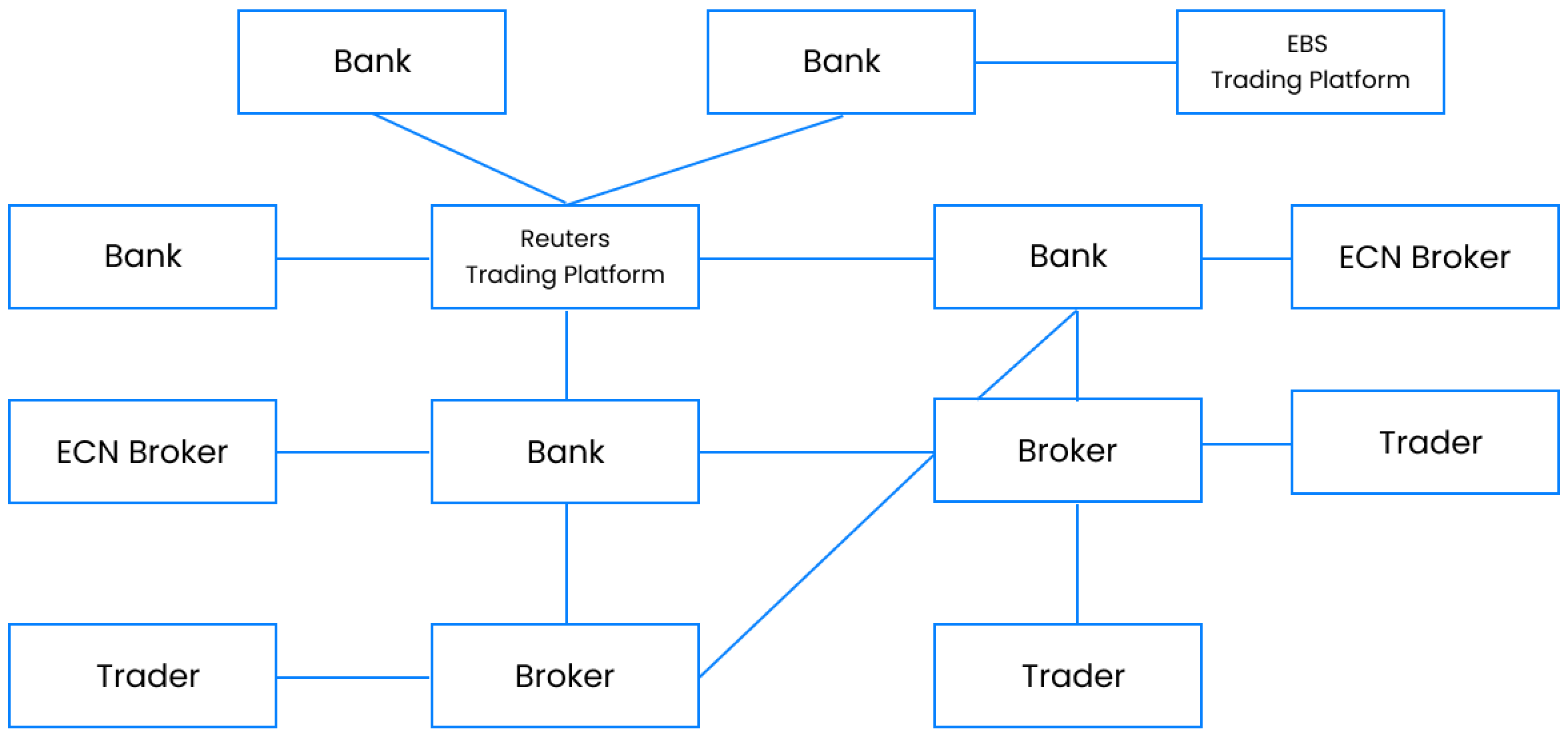

Forex, therefore, has the character of an OTC (over-the-counter) market. It works on the basis of the connection between dealers and traders.

Comparison for the retail trader

Centralized market

The centralized market is characterized by high standardization in terms of the size of traded contracts, trading hours, and a uniform price for all participating brokers. The market is heavily regulated and completely transparent. It offers a wide range of products but is highly capital demanding.

Decentralized market

A decentralized market is characterized by different trading conditions, contract sizes, and trading hours among brokers. Even the prices of the same instruments may vary between brokers. However, the great competition between brokers means lower costs for traders and this comes with the so-called leverage effect.