Introduction to trading

Trading is very simple, but not easy at all. If that statement doesn’t make sense to you, you’ve probably heard of trading but don’t have much experience with it. Our educational project “The Trader’s Journey” aims to guide novice traders through everything they need to know, from the very basics and first steps in the markets to advanced topics with an emphasis on imparting practical experience. We won’t make any promises, trading is really simple, but your path to success in this business will not be easy and will require a lot of time and effort. It’s up to you how you approach it and if you are willing to do something for your success. Unfortunately, most people who try their luck in this industry started trading without dedicating their time to studying and therefore lost all their money right at the beginning. If you don’t want to belong to this group, you have come to the right place. Do you think you have what it takes to be a successful trader? Let’s find out!

As in any other industry, the basis of success in trading is an honest study of the basics, supported by the gradual acquisition of experience and the development of your skills and abilities. In this introductory section, we’ll show you what trading actually is, how and why to get started, what your prerequisites should be, and what you’ll need to learn before you can use specific strategies and apply them in the real market. We’ll cover a few basic terms from our glossary, and at the end you’ll try out a trade to get an idea of what trading actually involves.

What is trading?

The word ‘trading’ can have a fairly broad meaning, but essentially, it is the buying and selling of various financial assets to make a profit based on fluctuations in the prices of those assets. You can trade virtually any financial asset that has a financial value and as a trader you can then speculate on the rise or fall of that value. At the same time, you may have a myriad of financial assets at your disposal.

What Trading Involves?

Trading is about understanding and integrating several key areas. True mastery requires many hours of hard work. It is a very immersive activity that is a cycle of skill development, mental preparation and application of acquired knowledge. It also involves analysing results, looking for room for improvement, and correcting possible mistakes and shortcomings. If you want to become an active trader, it will be a never-ending process of learning and improving your skills with one goal, and that is consistency in attitude, in preparation, in daily routine and ideally, of course, in profitable trades.

Investing vs Trading

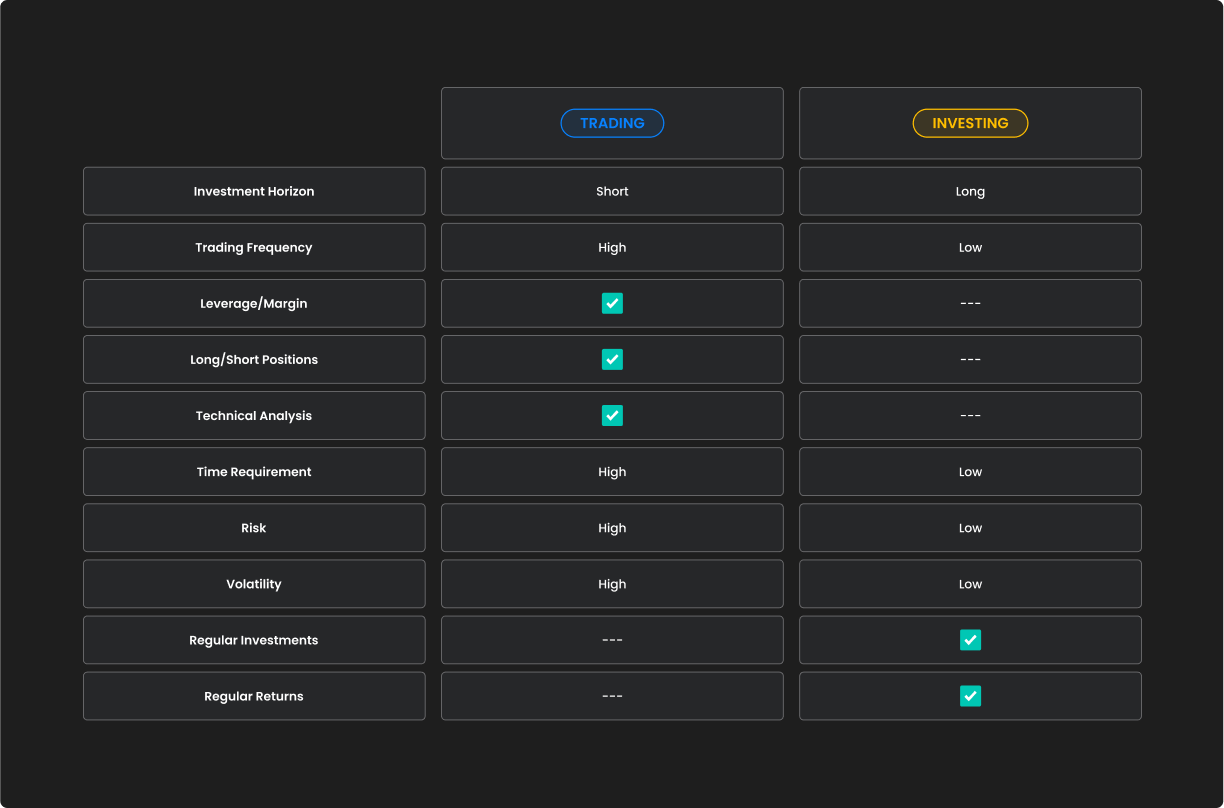

Many people confuse trading with investing, but there are some basic differences. The difference between trading and investing is, among other things, how you make a profit and whether or not you become the owner of the asset.

The investor’s goal is to purchase a financial asset at a favourable price with the expectation of its appreciation in the long term. They anticipate that the market price will increase over time, allowing them to profit from the price difference when they sell the asset at a higher price. Additionally, investors may earn regular returns from owning the asset itself. For example, shareholders may receive dividends (if the company distributes them) and can participate in company governance through voting rights associated with their shares. Bondholders, on the other hand, receive regular annual interest payments in the form of coupons.

Traders, on the other hand, seek to make a profit through speculation, usually in the short to medium term. Due to their higher volatility (a measure of the fluctuations in the price of financial assets), currency pairs and derivatives are suitable for these short-term trades. In these, the trader does not own the asset and can trade in either direction (long/short) without problems.

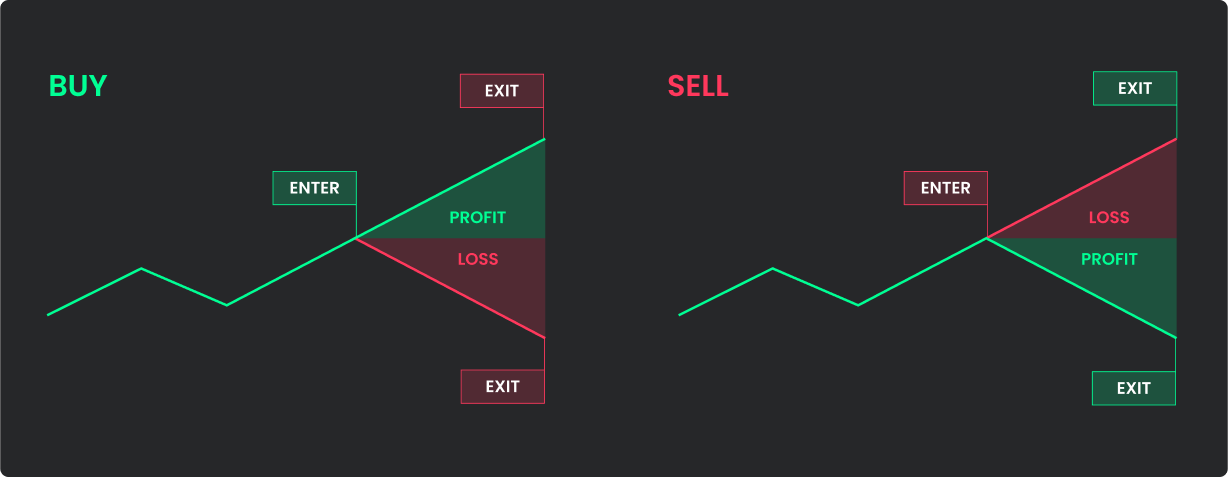

In a long position, traders speculate on the asset’s value increasing. They aim to enter the position at a low price (buy) and exit at a higher price.

When speculating on a decline in the value of an asset (short position), they enter the position at the highest possible price (sell) and exit the position at the lowest possible price.

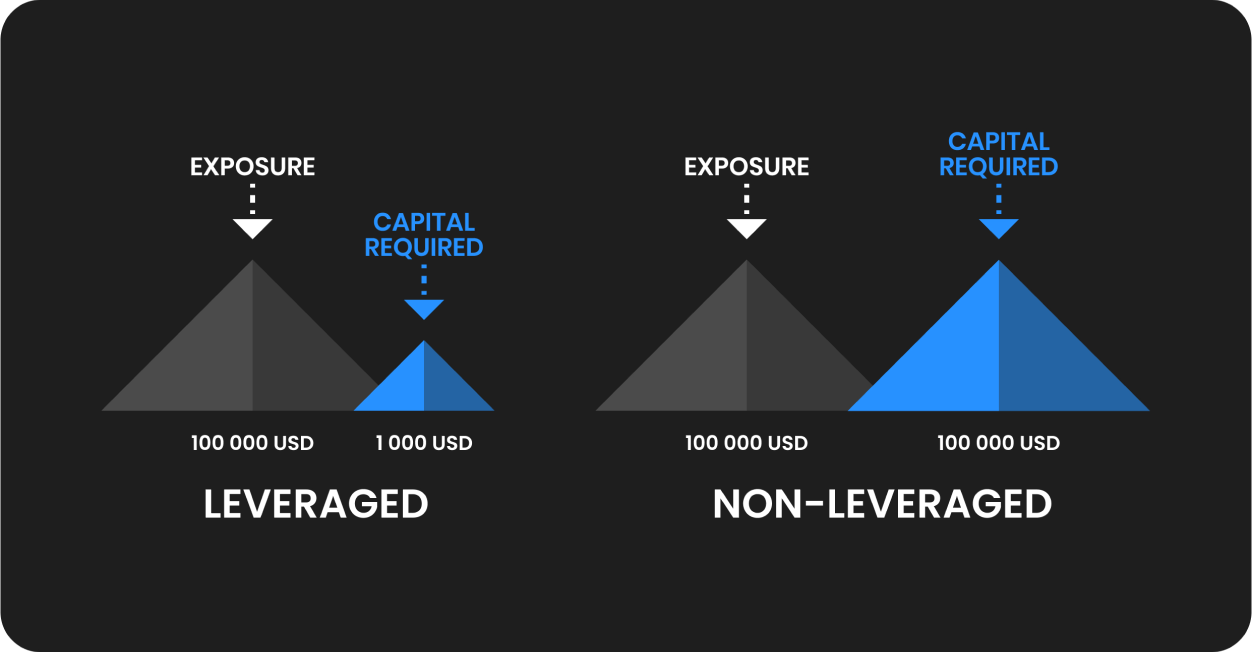

Another advantage of these instruments, which is mainly used by retail traders, is the use of leverage. Leverage allows you to open large positions with very little equity thanks to borrowed capital. Borrowed capital thus multiplies asset price movements and increases potential profits. At the same time, however, it is important to remember that higher potential profits are also associated with higher potential losses.

In the example below, you can see how much money you would need if you were to open a trade of 1 lot (base unit) on the EURUSD currency pair. Without leverage, you would need $100,000, with 100:1 leverage you would only need $1,000.

Who Can Become a Trader?

Anyone can become a trader. According to FTMO data, traders come from diverse backgrounds—regardless of education, nationality, location, family wealth, or gender. One of the appealing aspects of markets is their non-discriminatory nature; outcomes are determined solely by one’s attitude and ability.

Most people think that only someone who knows macroeconomics and microeconomics, excels in mathematics and is great at chess can become a trader. The reality is that you need slightly different qualities and skills to become a successful trader. As we have already mentioned, a willingness to learn new things is essential. The very important qualities of any trader should be perseverance and mental toughness, discipline, humility and an open mind.

Persistence is one of the key qualities of a trader. It is common to have good and bad periods, even when your results are already consistent and long-lasting. You can’t trade without losses, and the claim by some “trading gurus” that their success rate is close to 100% is unrealistic hogwash. Getting used to the fact that as a trader, you will sometimes have to endure a series of five or ten losing trades in a row will not be easy. It will require a very large dose of patience, perseverance and mental toughness. But we, with the help of our performance coaches, will help you through these challenging periods.

We must not forget discipline in all its forms. That is why there are so many successful traders among athletes who have been taught discipline from a young age and take it for granted. You probably know yourself that without a disciplined approach you cannot become a top expert in any field, and trading is of course no exception. Discipline is certainly not a 100% guarantee of long-term success, but it is a prerequisite without which you will never climb out of mediocrity. Discipline will help you avoid the phase where you constantly change your approach and strategy because you feel that “it’s not working”.

Unfortunately, humility is lacking in many traders who fail to be profitable in the long run, but always look for mistakes in someone else. The results of a forex trader are influenced by a myriad of factors over which he or she cannot have 100% control. Such an environment creates room for error. A good trader must be aware of this and should be able to admit his mistakes to himself and ideally always learn from them. A humble trader doesn’t feel that he knows everything, doesn’t overestimate his abilities, and is also able to keep his emotions in check.

Psychological well-being is one of the most important factors leading to success in forex trading, which is why we devote an extensive chapter to it in our course. There, you will of course also learn about the importance of self-knowledge and self-development, which our psychologists will certainly help you with in the later stages when you are already trading.

Curiosity and the willingness to learn new things are then closely related to all of the above. Indeed, when a trader has enough humility, he or she realizes that success in forex trading requires constant learning, improving one’s skills and knowledge. A trader can then be persistent enough, but without enthusiasm and interest in the subject, even this persistence quickly fades, because if something is done just for the money, it will not work in the long run.

Expected Earnings of Traders

Most traders only become interested in education after they have lost their first money in the markets or, in the worst case, lost all their capital in their trading account. This is a valuable (and often very expensive) lesson that needs to be remembered well.

Most traders lose money in the beginning; that’s a hard fact. The 90/90/90 rule states that 90% of traders will lose 90% of their invested capital within 90 days. You may have seen campaigns by various influencers claiming to make thousands of dollars a day from exotic beaches with just a few minutes of work. Dispel these notions immediately and permanently, because having excessively high expectations is a recipe for long-term failure. A trader who expects immediate and substantial earnings from forex trading will sooner or later experience disappointment and frustration. This isn’t to say you should set small, easily achievable goals; rather, you need to be realistic.

Where to Start?

If you’re like most people, you’re probably eager to open your first trade. We’ll get to that shortly to satisfy your curiosity. However, before diving into real trading, we recommend starting in a simulated environment to familiarise yourself properly and understand the essentials.

Before transitioning to real trading after studying our materials, practice with mock trading on a demo account. At FTMO, we offer a demo account through our FTMO Free Trial. Here, you can familiarise yourself with the trading platform, execute trades under real market conditions without risking your money, observe how the markets function, and gain insights into trading practices such as setting Stop Losses (the maximum acceptable loss per trade) and Take Profit levels (the desired profit).

In a demo account, you’ll also learn how to interpret charts and test basic strategies. Take your time—preparation in a demo account should not be underestimated.