Market Correlations

Understanding market correlations can provide us with an edge in the markets in terms of seeking new opportunities. Besides, knowing what assets are correlated can significantly reduce our exposure as we can diversify and deploy our resources elsewhere. This lesson will cover everything we need to know about market correlations.

Market correlations

Besides correlations in forex, there are also some interesting correlations in commodities and indices markets. Since FTMO is offering these instruments as well in the form of CFDs, we will cover them in this article. Also, bear in mind that correlations very often break and they are more obvious on larger timeframe horizons. If we are focusing solely on day trading or short term trading, we can see that correlation between different assets is getting stronger and weaker. Correlation should be viewed as a factor of possible confluence, not a be-all and end-all.

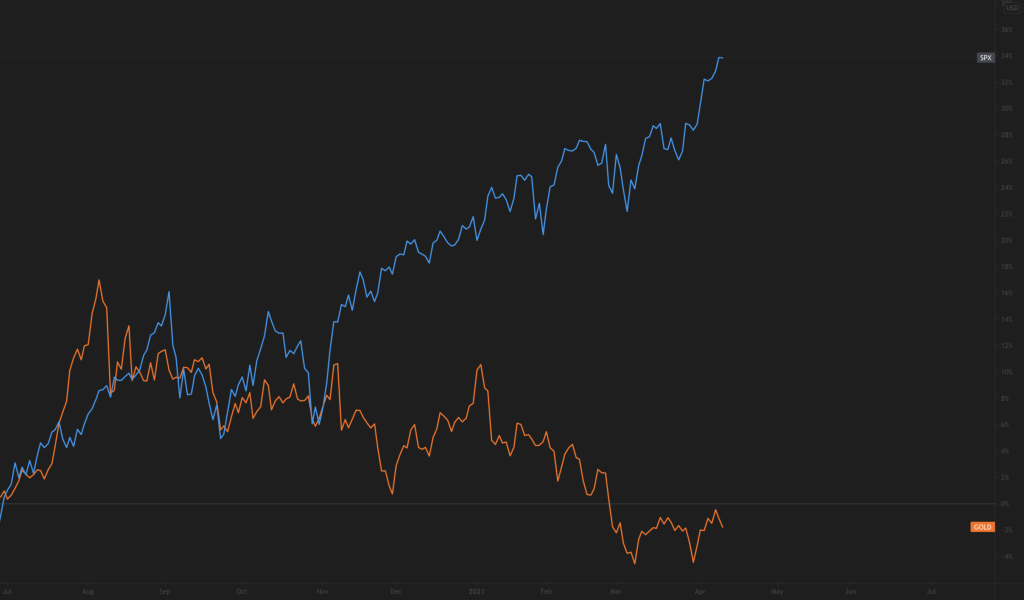

Equity indices and safe-haven assets

This is something we spoke about in our risk-on vs risk-off article. When equities and equity indices go down, fear prevails in the markets. This means that traders and investors move their assets into safe havens such as gold, yen or bonds.

In this case, we are talking about a negative correlation since one asset is going up and the second is going down, often with a high degree of mirroring.

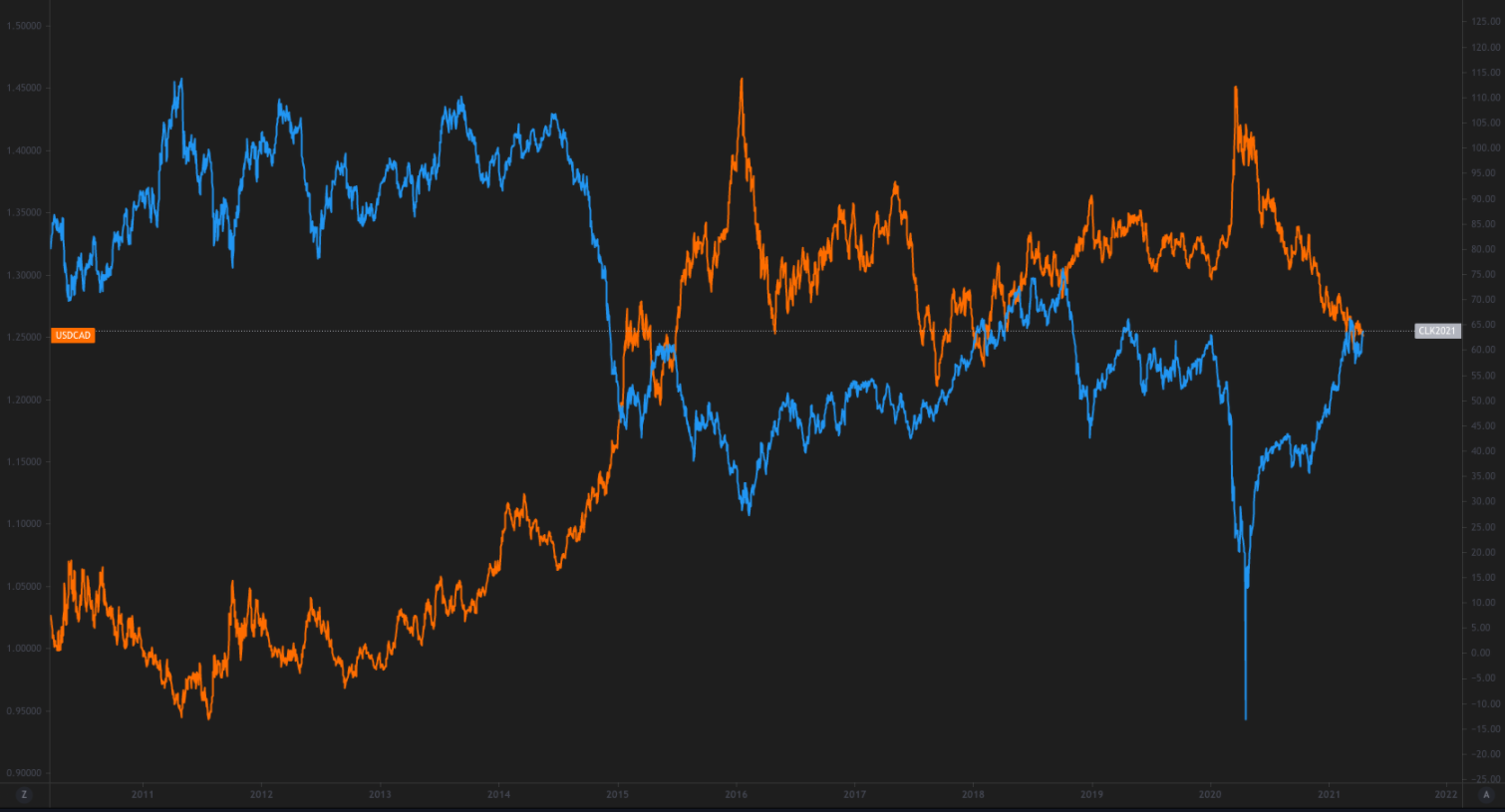

Canadian dollar and crude oil

Crude oil is very important for the Canadian economy. Because of that, prices of crude and Canadian dollar are positively correlated. In the forex trading world, it means that rising prices in crude oil are equal to falling prices of USDCAD.

The Australian dollar and Canadian dollar

Both Australian and Canadian economies are heavily dependent on commodities. Australia is connected with precious metals (iron ore, gold) and Canada with crude oil. Thanks to that, we can see a strong inverse correlation between AUDUSD and USDCAD.

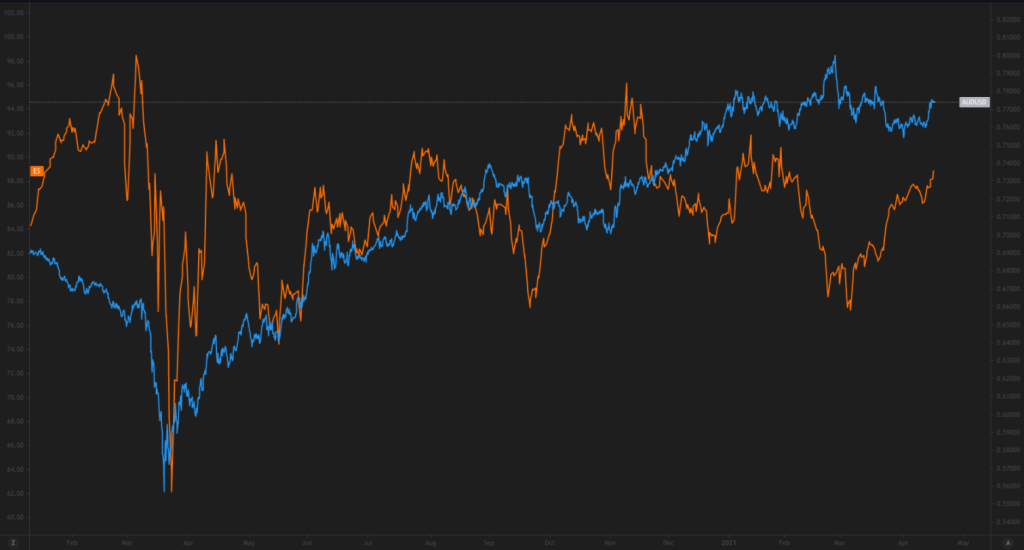

Equity indices and AUDUSD

Due to the Australian economy’s dependence on export, there is a positive correlation between AUD and equity indices as they reflect the strength of the world’s economy. If the Australian dollar is rising, we can see a positive correlation with the global economy. The most popular index to watch is the S&P500.

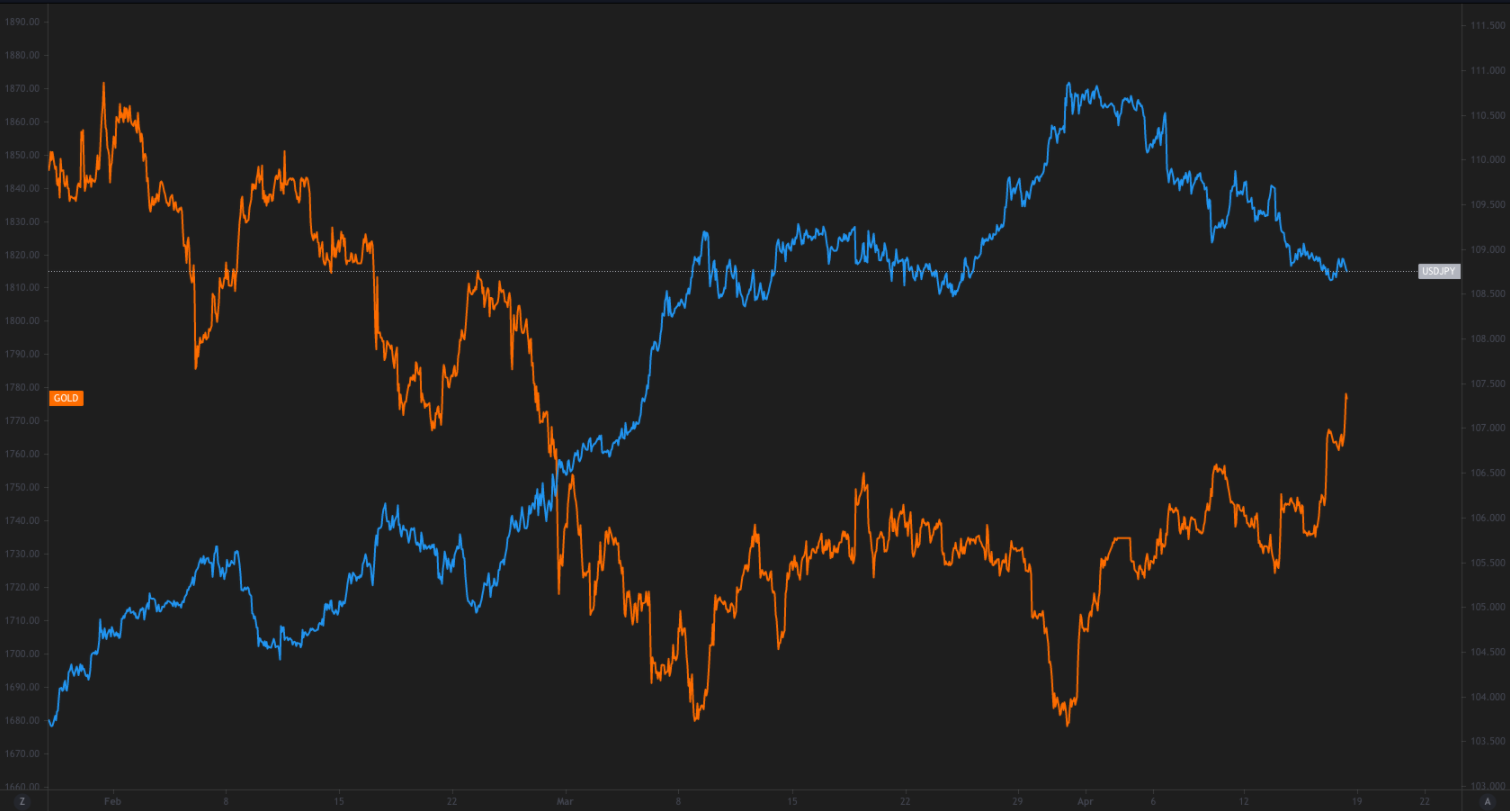

Gold and USDJPY

There is a high negative correlation between gold and USDJPY. If gold goes up, USDJPY usually falls.

This is due to the fact that both gold and Japanese yen are considered safe-haven assets, therefore, when there is a fear in the markets, traders tend to move their capital into gold and Japanese yen.