What is traded in Forex? Currencies and Correlations

There is a large number of currencies we can trade. This can easily confuse newer traders. In this lesson, we will look at currencies we can trade in the forex market and put them into different categories. When we are trading forex, all currency pairs have the same structure. For example, if we have EURUSD, the euro is called the base currency, and the dollar is the quote currency.

For the currency pair USDJPY, USD is the base currency, and JPY is the quote currency. If we are going to open the broker window with available instruments, we will see the names of currency pairs and prices. For example, when we see EURUSD trading at 1.3, we will need 1.3 units of the quote currency to buy 1 unit of the base currency. To simplify things, we need 1.3 US dollars to buy 1 euro. Most of the world’s countries are using their own currency. But businesses are done all around the world, so there is a high demand for a lot of these currencies. As we have many currency pairs in the world, we separate forex pairs into three brackets.

Majors, minors (also called crosses) and exotics.

Majors

Majors are the most traded and liquid currency pairs. All of them are paired with the US dollar since the US dollar makes more than 80% of all trades in the forex market. So which currencies are the majors? The most traded currency pair is EURUSD, nicknamed Fiber. The Euro currency’s nickname Fiber has the least known explanation. Still, many say that it comes from the fact that the paper used for euro banknotes consists of pure cotton fiber, making it more durable and giving it a unique feel. Next is the British pound, GBPUSD, also called the Cable. The name Cable comes from the fact that in the 19th century the exchange rate between the US dollar and the British pound was transmitted across the Atlantic by a large cable that ran across the ocean floor between the two countries. AUDUSD, we call Aussie, NZDUSD, is called Kiwi.

All these mentioned pairs start with foreign currency first and US dollar second. The last three majors work the opposite; the US dollar is first and the foreign currency is second. We have the Canadian dollar, USDCAD, which we call Loonie. The Loonie refers to the one Canadian dollar coin and derives its nickname from the picture of a solitary loon on the reverse side of the coin. The others are USDCHF, called Swissy and USDJPY, called Ninja. These seven currency pairs are so-called majors. EURUSD is the most liquid and traded currency. In the second place, we have USDJPY.

Minors/Crosses

These pairs are not quoted with US dollars but against each other. EURGBP, AUDJPY, NZDCHF and so on. These pairs are usually less liquid but offer a great opportunity for traders who don’t want to be exposed to the US dollar.

Exotics

Exotics include currencies from all over the world. We can find Polish zloty, Hungarian forint, Hong Kong dollar, Swedish crown, Czech crown and many more. These are usually less liquid than crosses and more suitable for longer-term positions than day trading.

Correlations

Some of the major currencies are tightly correlated with both indices and commodities. The Canadian dollar is positively correlated with crude oil because Canada is a significant oil producer and exporter. That means that an increase in oil prices usually means an increase in the Canadian dollar value. Transfer this to trading forex trading, when oil prices go up, the USDCAD goes down. Similarly, the Australian dollar and gold have a positive correlation because Australia is a significant gold producer and exporter. Both gold and the Japanese yen are viewed as safe havens in times of uncertainty, and these two are also positively correlated. Meanwhile, gold and the US dollar typically have a negative correlation. When the US dollar starts to lose its value amid rising inflation, investors seek alternative stores of value, such as gold. We also should be mindful when trading majors itself.

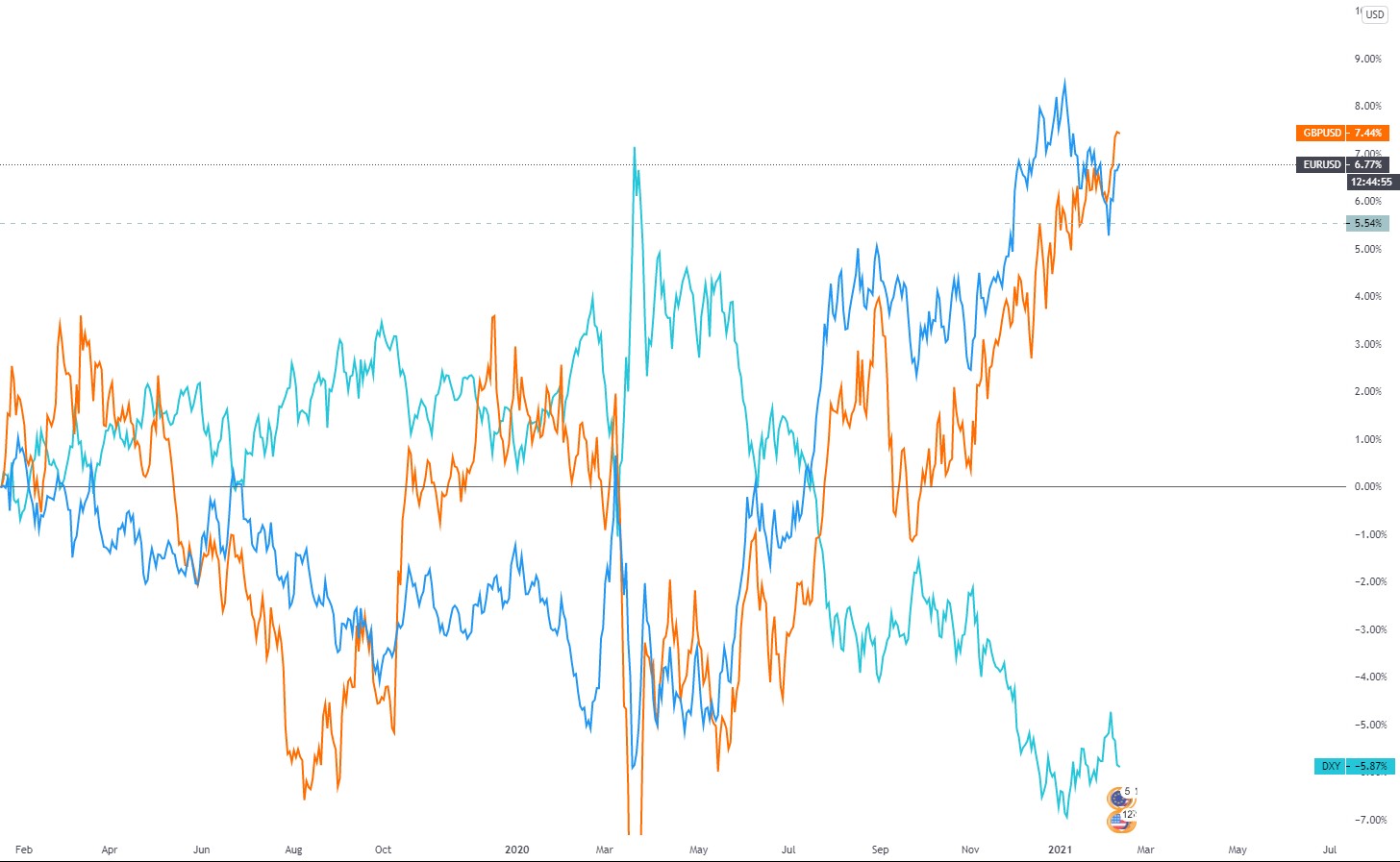

If we are going long on EURUSD and going long on GBPUSD as well, we are expressing the opinion that the US dollar should weaken and those currencies strengthen. But if the US dollar gains strength, both the euro and pound will most likely go down due to a strong inverse correlation to the US dollar, which can be seen in the chart below. The blue line represents EURUSD, the orange line GBPUSD, and the Dollar Index’s green line.

We should always pay attention to correlations because putting too much money on several tightly correlated assets can result in more considerable losses than anticipated.